dallas county texas sales tax rate

As of the 2010 census the population was 2368139. The December 2020 total local sales tax rate was also 6250.

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Dallas collects the maximum legal local sales tax The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

. Some cities and local governments in Dallas County collect additional local sales taxes which can be as high as 2. The Texas sales tax rate is currently. The average cumulative sales tax rate between all of them is 825.

Dallas is in the following zip codes. This is the total of state and county sales tax rates. The current total local sales tax rate in Dallas TX is 8250.

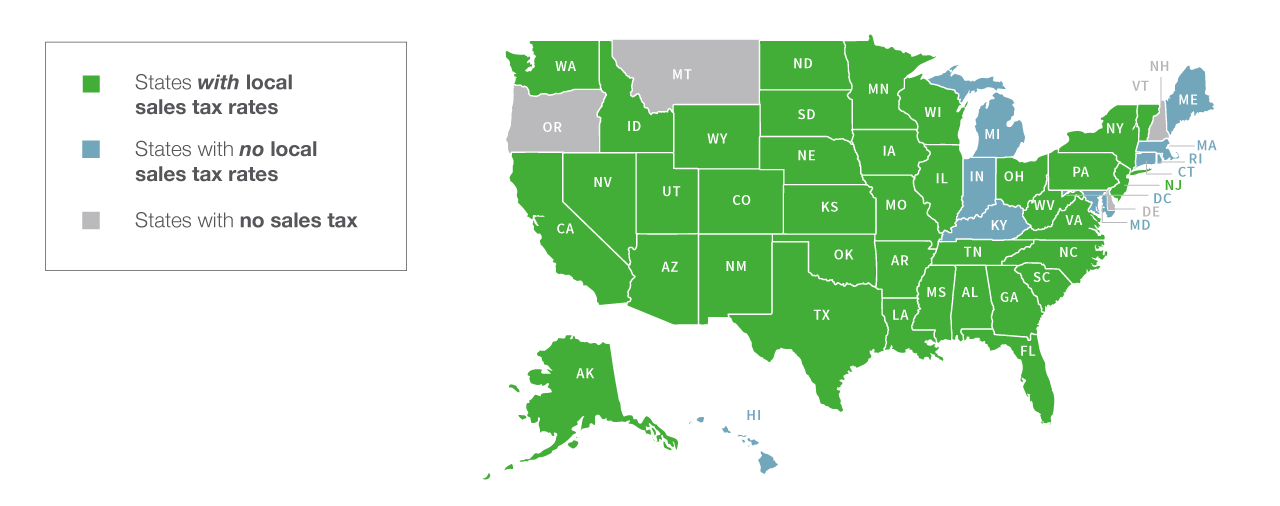

Ad State and Local Taxes that Businesses Should Consider for Relocation. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable servicesLocal taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. A full list of these can be found below.

The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. You can print a 825 sales tax table here. The Texas state sales tax rate is currently 625.

The Texas sales tax of 625 applies countywide. Texas is one of only 7 states not to have a state income tax. Dallas County Texas Sales Tax Rate 2022 Up to 825 Dallas County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Dallas County does not.

Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825. Anderson Mill TX Sales Tax Rate.

The average cumulative sales tax rate in Dallas Texas is 825. Wayfair Inc affect Texas. Click any locality for a full breakdown of local property taxes or visit our Texas sales tax calculatorto lookup local rates by zip code.

There is no applicable county tax. You can find more tax rates and allowances for Dallas and Texas in the 2022 Texas Tax Tables. EY Reviews Why Asset Management Firms are Heading to Texas.

2022 Texas Sales Tax By County Texas has 2176 cities counties and special districtsthat collect a local sales tax in addition to the Texas state sales tax. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. See photos schools nearundefined property taxes and more details.

The Dallas sales tax rate is. Free sales tax calculator tool to estimate total amounts. Fast Easy Tax Solutions.

Texas does have a back to school sales tax holiday once a year generally around the first weekend in August on clothing and footwear under 100. It is the second-most populous county in Texas and the ninth-most populous in the United States. The December 2020 total local sales tax rate was also 8250.

The County sales tax rate is. Within Dallas there are around 80 zip codes with the most populous zip code being 75217. For tax rates in other cities see Texas sales taxes by city and county.

Andrews County TX Sales Tax Rate. Look up 2021 Texas sales tax rates in an easy to navigate table listed by county and city. Get rates tables What is the sales tax rate in Dallas Texas.

Andrews TX Sales Tax Rate. The most populous location in Dallas County Texas is Dallas. Dallas County is located in Texasand contains around 21 cities towns and other locations.

The minimum combined 2022 sales tax rate for Dallas Texas is. The combined sales tax rate for Dallas County TX is 725. Sales Tax Breakdown Dallas Details Dallas TX is in Dallas County.

Ad Find Out Sales Tax Rates For Free. As for zip codes there are around 138 of them. This includes the rates on the state county city and special levels.

Dallas is located within Dallas County Texas. Did South Dakota v. 2021 Tax Year Rates New in 2021 Notice of Tax Rates Form 50-212 Tax Rate and Budget Information Tax Code 2618 For more information related to Dallas County tax rates please visit the Dallas County Tax Office website.

DC College District. The sales tax rate does not vary based on zip code. The state sales tax rate 625 is above the national medium with localities adding up to 2 825 total.

Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas. 75201 75202 75203. Dallas in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Dallas totaling 2.

Dallas County is a county located in the US. Anderson County TX Sales Tax Rate. View home details for3038 Claibourne Boulevard Dallas TX 75212.

This is the total of state county and city sales tax rates. Name Local Code Local Rate Total Rate. Get EYs Latest Insights.

Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas County TX is 6250.

Texas Sales Tax Guide For Businesses

Texas County Challenge Texas County Map Texas County Texas Map

Mortgage Rates Have Dropped To The Lowest Level In Four Months And More Short Term Decline Is Forecast Read Starting A New Job Future Jobs How To Find Out

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Guide For Businesses

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

How To File And Pay Sales Tax In Texas Taxvalet

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

How To Charge Your Customers The Correct Sales Tax Rates

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Sales Tax Guide And Calculator 2022 Taxjar

Texas Sales Tax Rates By City County 2022